All Categories

Featured

Table of Contents

A private have to have a web well worth over $1 million, omitting the key home (individually or with partner or companion), to certify as an accredited financier. Demonstrating adequate education and learning or work experience, being a registered broker or financial investment consultant, or having particular expert qualifications can also certify a specific as an approved capitalist.

Accredited investors have access to investments not signed up with the SEC and can consist of a "spousal matching" when establishing certification. Approved capitalists may face potential losses from riskier financial investments and have to prove economic sophistication to join unregulated investments (qualified investor definition). Certified financier status issues since it establishes eligibility for financial investment opportunities not offered to the basic public, such as private positionings, equity capital, bush funds, and angel investments

Accredited Investor Canada

To get involved, accredited investors have to approach the provider of unregistered safety and securities, who might need them to complete a set of questions and give monetary papers, such as income tax return, W-2 kinds, and account statements, to verify their standing. Laws for accredited capitalists are managed by the U.S. Securities and Exchange Compensation (SEC), guaranteeing that they fulfill details economic and specialist standards.

This expansion of the certified financier swimming pool is planned to maintain capitalist security while supplying better accessibility to non listed investments for those with the essential economic class and threat resistance. - regulation d securities act accredited investor

Non-accredited Investor

Actual estate submission is rather similar to REITs because it additionally involves pooling sources to buy property investments. A syndication bargain is when multiple capitalists pool their resources with each other to purchase a solitary actual estate residential or commercial property. This deal is assembled by a syndicator, likewise known as the general enroller.

These capitalists will supply a lot of the funding needed to acquire the home. The difference with REITs is that you can select what submission offers to join. If you rely on the genuine estate building being syndicated, you can join as one of the passive financiers. Property submission can be done with any type of kind of property, but multifamily submission is one of the most prominent kind since multifamily residential properties typically generate a whole lot of consistent income.

Additionally, these big residential or commercial properties are typically tougher to get as an only capitalist, which is why submission is an ideal configuration. Capitalists can get involved in multifamily real estate spending with a much reduced minimal financial investment.

Accredited financiers do not need to gather rental income, take care of occupants, deal with emergencies, invest money on fixings, and so on. Either the syndicator will employ a 3rd event residential property supervisor to do this or they will certainly manage it themselves - accredited investor. Each event in the multifamily submission financial investment possesses a portion of the property.

Often the syndicator has a bigger percent of the equity. The capital is typically split among the participants. This implies capitalists obtain easy income from leas, and the eventual building sales. This is based on what percentage of the building they possess, depending on the bargain structure.

Accredited Investor Letter Template

Our point of views are our own. An approved investor is an individual or establishment that can invest in unregulated securities.

Unregistered safety and securities are inherently dangerous however usually use greater rates of return. If you've ever encountered an investment readily available just to supposed accredited investors, you have actually most likely questioned what the term implied. The tag can put on entities ranging from massive banking organizations and wealthy Lot of money 500 companies, completely to high-earning houses and even individuals.

Offering to recognized financiers is simply one of those exemptions, covered by SEC Regulation 501 under Law D of the Stocks Act of 1933. The regulation was prepared as a federal government response to the Great Anxiety, providing market accessibility to smaller sized companies that could or else be crushed under the costs going along with SEC enrollment.

Investors without accreditation can handle the complete breadth of authorized protections like supplies, bonds, and mutual funds. They can additionally accumulate riches, acquisition realty, develop retirement portfolios, take dangers, and reap incentives the largest difference remains in the scale of these ventures. Among the advantages of being a recognized capitalist is that once you obtain this standing, it "unlocks" access to products not readily available to the public, such as hedge funds, endeavor resources funds, exclusive equity funds, and angel investing.

The SEC thinks about hedge funds an extra "adaptable" investment method than something like mutual funds, because hedge funds utilize speculative techniques like take advantage of (sec accreditation requirements for auditors) and brief marketing. Since these complex items call for extra research and understanding, capitalists require to show that they comprehend the risks associated with these kinds of financial investments prior to the SEC is comfortable with them diving in

While numerous are mostly acquainted with the SEC's consumer protection initiatives, the governing authority's commitments are really twofold. Along with securing investors, it's likewise in charge of resources development essentially, helping the marketplace build up funding. To guarantee that those two initiatives aren't in dispute, it's sometimes required for the SEC to compare high-risk, high-reward chances with suitable investors.

Accredited Investor Solutions

One assists browse the uncontrolled market, and the other will float you to safety ought to the waves threaten. The ordinary capitalist is secure on the coastline or paddling in the shallows, secure under the careful gaze of the lifeguard (i.e., the SEC). Securities that are readily available to recognized investors are supplied through exclusive offerings, which might come with less regulations than safety and securities supplied to even more routine financiers.

By Percent - January 11, 2021 When it concerns purchasing stocks and bonds, practically any person can invest. As long as you more than the age of 18 (or 21, in some states), not trading on details, or not spending as component of a problem of passion, you can be a component of public markets whether you have $1 or $1 million.

Particular investment automobiles including those on Percent are only available to a course of capitalists legally defined as These financiers have the specific authorization from governing bodies based on a slim collection of standards to buy particular sorts of investments in private markets. But that can be a recognized capitalist? Better yet, why are accredited investors a thing to begin with? After the Great Anxiety, the U.S

This act required investors to have a better understanding of what they were buying, while forbiding misrepresentations, fraudulence, and deceit in safety and security sales. Congress presumed this legislation would certainly protect the "normal" investor. Personal offerings those outside of the general public supply exchanges were excluded from safeties laws, which developed some issues.

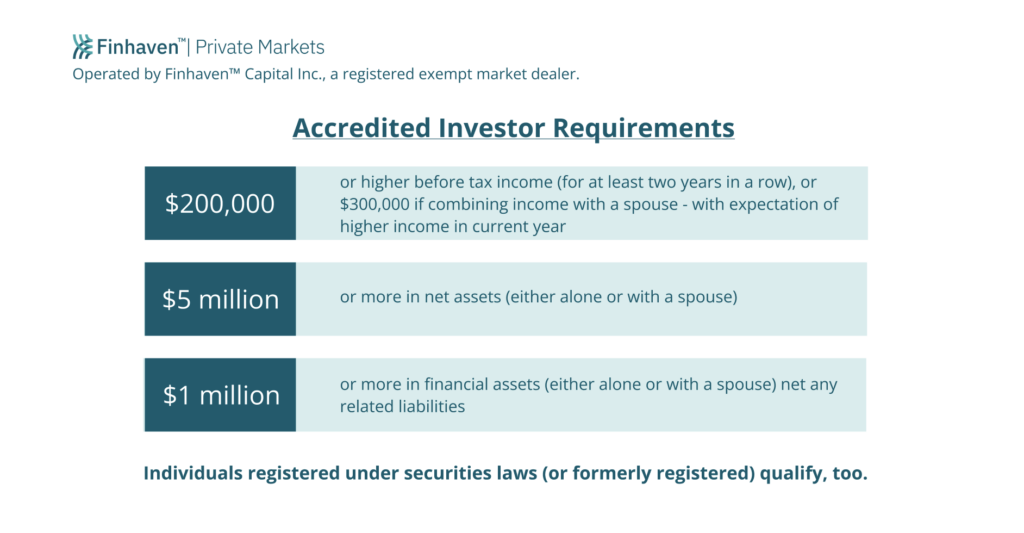

The Stocks and Exchange Commission (SEC) ultimately took on policy 501 of Guideline D, which formalized that can spend in private offerings and specified the term "accredited financier" a term that was later on upgraded in 2020. A recognized financier is any individual that fulfills any one of the adhering to criteria: Financiers with made income that surpassed $200,000 (or $300,000 with each other with a spouse) in each of the prior 2 years, and anticipates to fulfill the exact same criteria in the current year.

If you are married to an accredited capitalist and share monetary sources, you are currently additionally a certified investor.) Those that are "experienced employees" of a private fund. Restricted Liability Firms (LLCs) and Family members Office entities with $5 Million possessions under administration. SEC- and state-registered investment advisors (yet not reporting advisors) of these entities can likewise currently be taken into consideration accredited financiers.

Verification Of Accredited Investor Status

As an example, if you have a total assets of over $1 million (not including your primary property/residence), made $200,000+ a year for the last two years, or have your Series 7 license, you can make investments as a recognized investments. There are numerous other certifications (as you can discover above), and the SEC strategies on including much more in the future.

Since the very early 1930s, federal government regulators have found it tough to protect capitalists secretive offerings and safety and securities while at the same time maintaining the development of start-ups and various other young business - companies that numerous believe are accountable for the bulk of job growth in the USA - accredited investor verification letter. Stabilizing this task had been center of the mind of the Securities and Exchange Commission ("SEC") for several years

Table of Contents

Latest Posts

Tax Deed Sales Ny

Ny State Property Tax Foreclosure

What Is A Delinquent Tax Sale

More

Latest Posts

Tax Deed Sales Ny

Ny State Property Tax Foreclosure

What Is A Delinquent Tax Sale